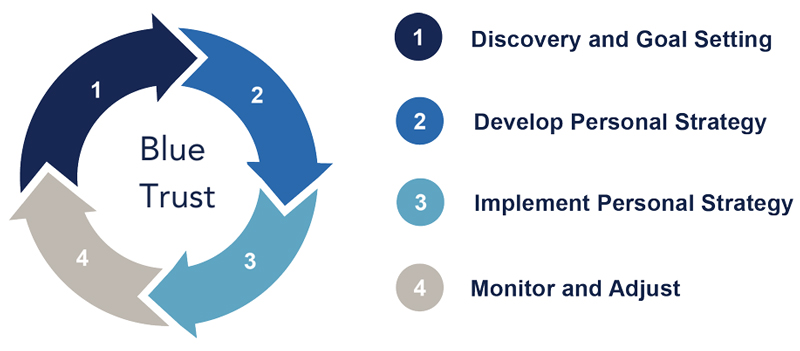

Financial Planning

“We first called Blue Trust to determine how soon I could retire. The Blue Trust organization guided us on a spiritual path at exactly the right time to focus us on God’s will at this stage of our lives and we will be forever thankful.”

– Jim & Norma W.*

Lake Elsinore, CA