Combining vision and action, a financial plan includes:

- Short-term cash flow planning based on “the five uses of money”

- Long-term retirement planning

- Minimizing debt proactively

- Understanding tax consequences of various decisions

- Funding your child’s education

- Determining how much insurance you might need

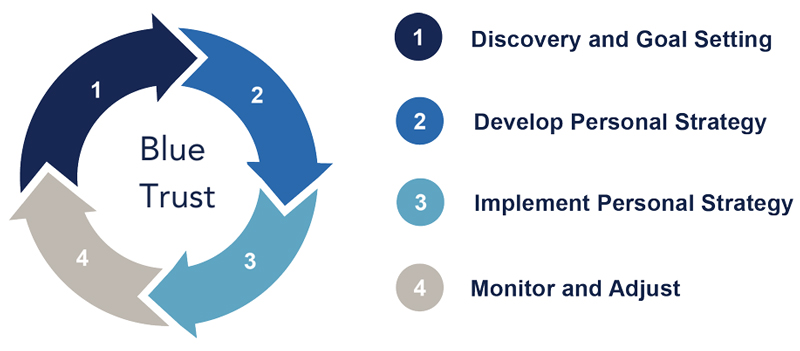

The Financial Planning Process

Our process and software take you directly from goal setting to the implementation of your plan. By understanding how all the components of your financial life integrate with each other, how it all connects, and how to adjust over time, we guide you through a detailed financial plan toward sound decisions, wise stewardship, and a road map to your desired destination: A life well spent.

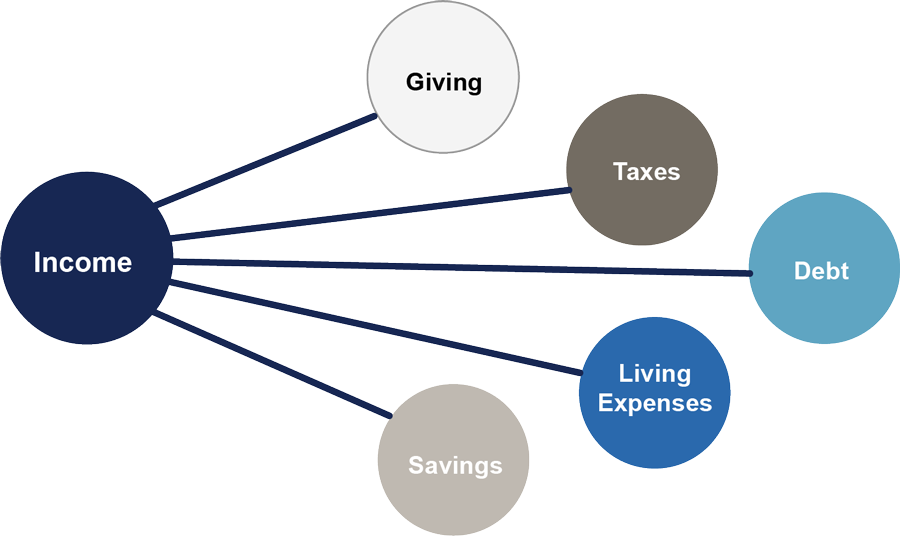

The Five Uses of Money

The answers to most financial questions are uncovered when you understand that there are only five uses of money and when you know exactly how much you are spending on each. Our comprehensive process helps you plan for living expenses, debt, savings, taxes, and giving.

Retirement

How Much Is Enough?

Retirement planning is much more than a magic number that answers the question “How much is enough?” It’s a process of you and your advisor working together to make sure you’re asking the right questions:

- How will I continue to provide for my family?

- How does retiring help me fulfill God’s purpose in my life?

- How will I determine what my next chapter is?

- How can I use my savings in a tax-efficient manner?

- How will inflation, investment returns, and personal decisions impact my time frame?

As you approach retirement, don’t look at it as an end. Rather, look at it as a beginning. It is the start of the next phase in your service in God’s kingdom.

Charitable Giving

God Owns It All

One of the key benefits of having a comprehensive and strategic financial plan is being able to give generously. Helping clients with their plans for giving has been a central tenet of Blue Trust since our inception. Giving is key to becoming free from the power of money over our lives.

With wise charitable giving strategies, your giving plan can help you:

- Realize a deeper personal satisfaction from making a difference

- Gain a thorough understanding of the financial implications of giving

- Understand the strategies for giving assets in addition to giving cash

- Coordinate a giving strategy with your financial plan

- Feel confident that you are giving in a tax-efficient manner

- Prioritize your passions and goals for philanthropy

- Benefit from the freedom and personal joy that giving generously may bring

“We make a living by what we get. We make a life by what we Give!”

– Winston Churchill *

Taxes

It’s Not What You Earn, But What You Keep

With all of the tax laws and legislative changes, how do you successfully navigate the complex, always changing and confusing tax system? More importantly, how do you best take advantage of these changing laws in order to improve your financial stewardship and accomplish your goals?

Unlike tax preparation, tax planning is a year-round process, and should be an important part of your financial plan. It’s wise to consider tax reduction efforts in light of your overall goals.

Our tax planning process includes:

- Short- and long-term tax projections

- Understanding tax consequences of financial and life decisions

- Analysis to determine if your tax withholdings or estimated tax payments are sufficient

- Estimation of marginal and effective tax rates, and federal and state tax liabilities

- Coordination with your tax preparer that your tax planning goals are being met

- Tax savings opportunities through income shifting, deferment, deduction planning, and other timing strategies

Estate & Trust Services

Estate Plans Are Built During Your Lifetime

Estate Planning includes building an estate during your lifetime with a goal of ensuring that the assets in your estate are stewarded in a manner that meets your goals and objectives, and will be passed to your beneficiaries in a thoughtful way. It allows you the opportunity to preserve and control the purpose and distribution of your wealth during life and at death.

Guided and assisted by your Blue Trust advisor, you can create a strategy for your estate and legacy plan that is designed to empower subsequent generations and reflect your values and principles.

The estate planning process can provide you with many benefits, including:

- A plan to distribute your wealth according to your most important goals

- Assurance that your beneficiaries will be cared for by the people you choose

- A charitable giving strategy and tactics for design, implementation, and administration of the strategy

- Tax efficiency in distributing your assets

- A plan that is regularly reviewed and adjusted as circumstances change

- Alignment of your legal documents with your wishes to help your family organize and settle your estate

Blue Trust and its employees and affiliates do not provide legal or accounting advice or service. Work with your attorney or accounting professional for such services.